IRS seeks public feedback on tax return options after dismantling Direct File

The IRS is asking the public to weigh in on tax preparation and filing options as it officially closes the door on Direct File, the free electronic filing tool that earned sky-high consumer experience ratings but was shuttered by the Trump administration.

In an anonymous survey launched last week that runs through Sept. 5, the tax agency asks individuals how they prepared their most recent returns and whether they’d be interested in using a “free online tax preparation program” for their next federal return.

Respondents are then prompted to select features they’d like to see in a tool of this kind; some options include ease of use, ability to file federal and state returns simultaneously, and that the product “has a low cost to the federal government.”

The survey also seeks feedback on which organization should manage the program, whether it’s “paid and operated directly by a tax preparation company” and hosted on that firm’s website, a product also privately run but linked from IRS.gov, or a tool paid for and operated by the tax agency itself.

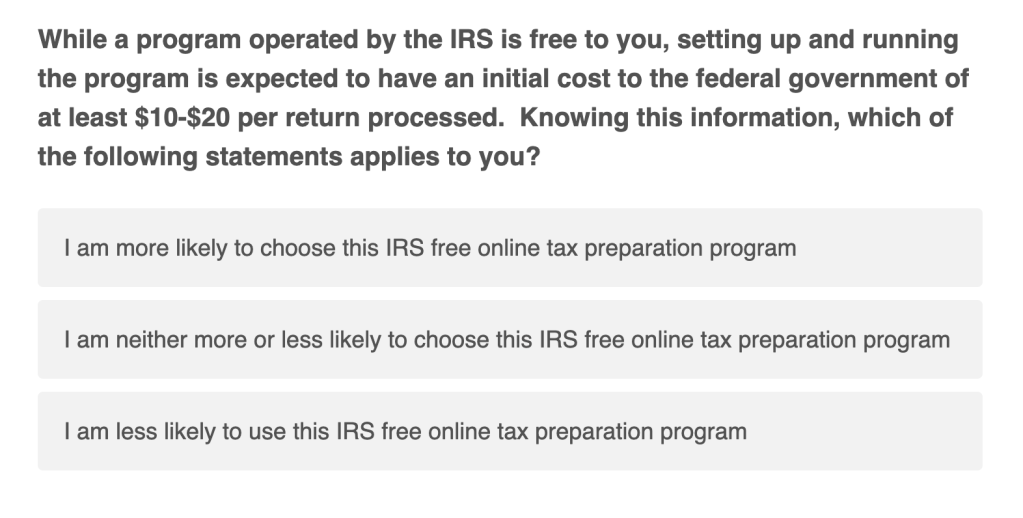

If a survey respondent selects the IRS-run choice, they receive a prompt that acknowledges the free cost to filers but notes that “setting up and running the program is expected to have an initial cost to the federal government of at least $10-$20 per return processed.”

In the yearslong campaign waged against Direct File by the tax preparation industry and congressional Republicans, the per-return cost was often cited as a reason to scrap the tool. A spokesperson for Intuit, the makers of TurboTax, told FedScoop in May 2024 that Direct File was “a solution in search of a problem and every American can already file their taxes for free, without any cost to the government or taxpayers,” pointing to the IRS’s Free File partnership with tax software companies.

Adam Ruben, vice president of campaigns and political strategy at the Economic Security Project, said in a recent interview with FedScoop that Free File “is not a viable solution.”

“According to the rules of the Free File Alliance, which is that the government promises to send people into private tax prep companies, 70% of Americans ought to be eligible, are eligible to file their taxes for free through that program, and yet, only about 3% of Americans successfully file for free,” Ruben said. “And so those programs are just a marketing program, a marketing tool for the tax prep companies. It’s a bait and switch.”

The launch of the new IRS survey fulfills a reporting requirement for the One, Big, Beautiful Bill Act, which calls on the Treasury Department to file a report to Congress by Oct. 2 on issues related to free tax filing options.

Per the bill text, the Treasury report should detail the costs associated with “enhancing and establishing public-private partnerships which provide for free tax filing for up to 70 percent of all taxpayers calculated by adjusted gross income, and to replace any direct e-file programs run by the Internal Revenue Service.”

The law appropriated $15 million to the Treasury Department to convene a task force and deliver the free filing report to Congress.