IRS dumps kiosks at tax centers after watchdog found dozens of inoperable machines

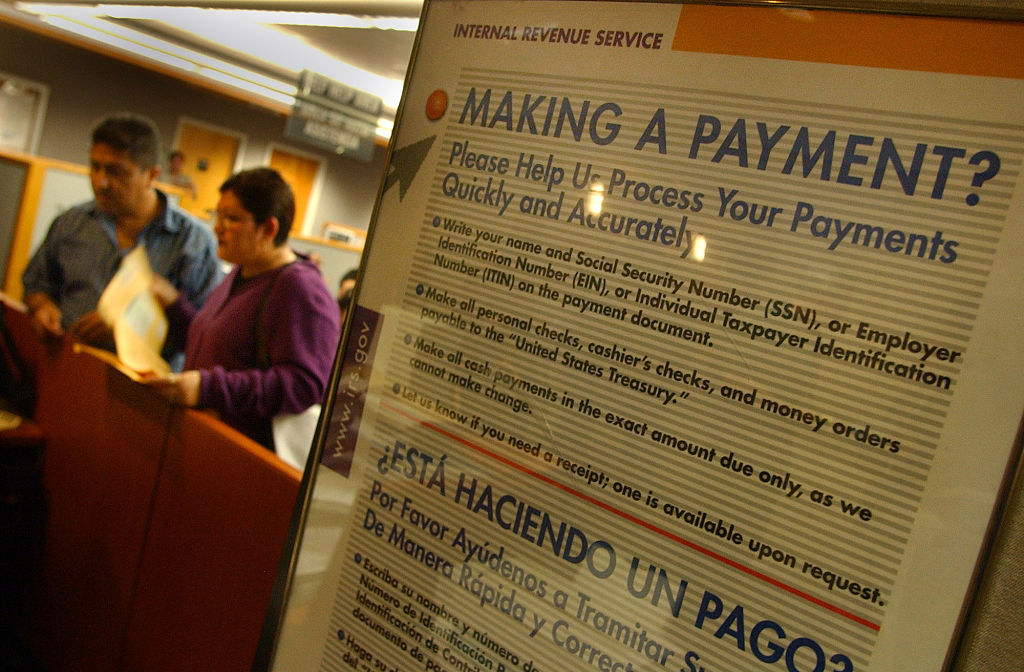

The IRS is scrapping its self-service kiosk program at Taxpayer Assistance Centers after a watchdog flagged that many of the laptop-powered machines were inoperable.

The Treasury Inspector General for Tax Administration revealed in a report last week that the IRS decided to not exercise an option with the contractor charged with managing the 100 IRS kiosks at 37 Taxpayer Assistance Centers across the country. The computer terminals provided walk-in customers with access to Free File, the Interactive Tax Assistant tool, the Electronic Federal Tax Payment System and other digital IRS services.

In April 2024, TIGTA alerted the IRS to the fact that 40 of those kiosks weren’t working. Managers at the TAC facilities told the watchdog that the contractor “was slow to respond to service requests,” leaving the kiosks unusable “for long periods of time.”

In response to TIGTA’s findings, the tax agency said it would work with the contractor — who was being paid $500,000 annually for kiosk upkeep — to make the machines operational by Dec. 31, 2024.

But when TIGTA revisited eight TACs in January, it found no progress on the supposed repairs to the kiosks. When informed of the issue, IRS management told the watchdog that it “was discontinuing the kiosk program.”

“IRS management did not state plans to cancel the contract until after we expressed concerns about the number of inoperable kiosks,” TIGTA noted.

The decision to sunset kiosk operations comes at a time when customer use of the machines has plummeted. According to IRS data, more than 80,000 taxpayers used the kiosks in fiscal year 2017. From January through July 2024, however, just 4,671 customers used the machines, per the data.

TIGTA’s report said the massive decline in usage could be chalked up to outdated technology and unusable machines, noting that the kiosks were 13 years old during the 2024 filing season. The watchdog said it was supportive of the IRS’s decision to end the current kiosk program, but “offering taxpayers a self-service option could be beneficial as the IRS reduces and restructures its workforce.”

“Since kiosks in TACs use laptop computers as a backbone, the agency could consider having laptops or another type of kiosk available for taxpayers to access IRS online services,” the report stated. “Expanding self-service options at TACs would also help taxpayers in rural and underserved communities.”

IRS management said it agreed with TIGTA’s recommendation to study the potential benefits of a new kiosk system with updated technology, in addition to assessing the “challenges of introducing a new program designed to offer modern self-assistive solutions for taxpayers.”