SEC chair considers ‘innovation exemption’ for in-house AI testing

The Securities and Exchange Commission is eyeing artificial intelligence sandboxes for entrepreneurs focused on “investor protection,” the regulator’s chief told lawmakers last week.

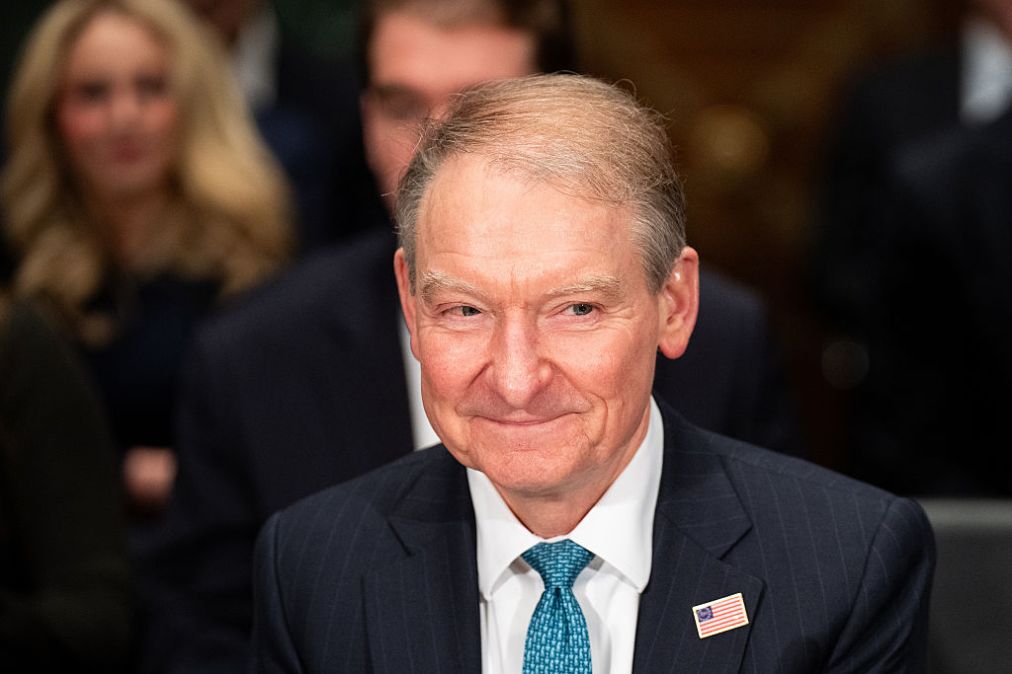

During a Senate Banking Committee hearing, Sen. Mike Rounds, R-S.D., asked Chair Paul Atkins if his bipartisan bill to establish enforcement-free AI testing at financial regulatory agencies would “give the SEC the tools it needs to foster responsible AI innovation.”

The Unleashing AI Innovation in Financial Services Act from Sens. Rounds, Martin Heinrich, D-N.M., Thom Tillis, R-N.C., and Andy Kim, D-N.J., would direct the SEC, the Federal Reserve, the Consumer Financial Protection Bureau and other federal financial agencies to create in-house AI innovation labs. The agency-run sandboxes would allow for testing of AI projects “without unnecessary or unduly burdensome regulation or expectation of enforcement actions,” per the bill text.

Atkins told Rounds he hadn’t yet reviewed the legislation, but he’s on board with the bill’s “premise” and has been mulling over a similar idea.

“I’ve been talking about an innovation exemption, to begin at the SEC, to allow entrepreneurs in a sandbox-like environment that’s … cabined, time-limited, transparent, flexible, and then focused on investor protection,” Atkins said. “So all of those principles, I think, are important, and to allow people to try different things in a particular environment and then prove their concept.”

Rounds noted in his questioning that the White House’s AI Action Plan has an explicit callout for the creation of “regulatory sandboxes” at agencies, including the SEC. Those sandboxes would be supported by the Department of Commerce via the National Institute of Standards and Technology’s AI evaluation initiatives, per the strategy document.

“This venue would allow SEC-regulated entities such as broker-dealers, investment advisers to test new AI tools under structured oversight,” Rounds said.

It remains to be seen whether Rounds’ bill moves forward in the Senate, and whether Atkins’ “innovation exemption” idea comes to pass. But the SEC already has some seemingly small-scale sandbox experience, according to its recently released AI use case inventory.

The SEC’s Office of Human Resources has deployed what it calls a “Training Conversation Tool” built by the AI management platform Skillsoft. The tool uses natural language processing to improve “communication and collaboration skills of the SEC workforce” — but is listed as “a training sandbox only.”

Later in the hearing, Atkins was pressed by Sen. Mark Warner on agentic AI and whether the SEC believes banks and broker-dealers have proper guardrails in place to make sure autonomous tools of that kind don’t “commit a malfeasance or something illegal.” The Virginia Democrat added that there’s “bipartisan interest in helping on this.”

Atkins said he shared Warner’s concerns, but “people are still experimenting” with the technology, so it’s probably too early to tell what’s happening “with respect to broker-dealers or anything else.” But Valerie Szczepanik, the SEC’s chief AI officer, is looking at AI tools that can help with enforcement, corporate finance reviews and other areas, Atkins said.

“So whichever way this technology grows and changes, I think we have to be very attuned to those potential problems,” Atkins said.