Financial regulators have ‘insufficiently’ addressed hedge funds’ use of AI, report says

Federal financial regulators are playing catch-up in their oversight of how hedge funds are using artificial intelligence to guide trading decisions, presenting a serious risk to market stability, the majority staff of the Senate Homeland Security and Governmental Affairs Committee warned Friday.

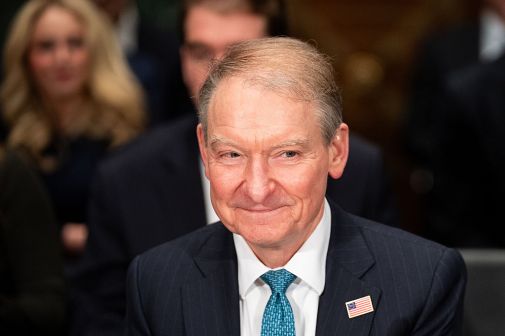

In a 45-page report, shared exclusively with FedScoop and led by HSGAC Chair Gary Peters, D-Mich., staffers found the combination of recent regulatory actions and the current federal legal framework to “insufficiently address the evolving uses of AI in the financial services sector, including by hedge funds in trading decisions.”

“The report also finds that the risks of future impacts resulting from AI use in investment decisions go beyond potential harm to individual investors and could have an impact on wider financial stability,” the authors wrote. “Use of more complex approaches to AI in the financial sector, absent any uniform basic guiding principles and industry-wide rules, increases risks to both individual investors and markets.”

The surging prevalence of AI across the financial services sector has been especially pronounced among hedge funds, the report noted of the investment vehicles that are responsible for more than $5 trillion in assets under management in the country.

Though the use of data analytics to inform trading decisions is nothing new in this world, the rise in AI and machine learning among hedge funds “amplifies traditional investment industry risks,” according to the report, opening the door to the triggering of “uniform movements by significant numbers of investors.” Current safeguards against such “herding” may not provide sufficient protections, the report warned.

At the same time, federal regulators’ work to mitigate AI-fueled risks is only “in its infancy,” the report noted. Securities and Exchange Commission Chairman Gary Gensler has repeatedly sounded the alarm on the risks AI poses to the sector, calling a financial crisis caused by the technology within the next decade “nearly unavoidable.” The SEC and Commodity Futures Trading Commission, which both regulate hedge funds, have started to examine the uses and risks associated with AI and investment vehicles.

“Despite these recent steps, regulators have yet to fully clarify how existing regulations apply to hedge funds’ use of AI in trading and there are yet to be established baseline standards specifically on the use of AI for trading purposes,” the report said.

Authors of the report — who conducted interviews with the SEC, CFTC, the Federal Reserve, the Financial Industry Regulatory Authority and the Financial Stability Oversight Council — reserved many of their recommendations for the financial regulators, coming to the conclusion that they “are not sufficiently coordinating their efforts to address concerns related to AI.”

The report pushes the SEC and CFTC to move forward with measures to address these risks, including: creating standards and guidelines for how hedge funds define trading systems that use AI; establishing operational baselines for hedge funds’ AI use, including testing and review of AI systems; and developing a risk assessment framework, following National Institute of Standards and Technology guidelines, that address AI-associated risks to financial markets, with reporting mechanisms for hedge funds built in.

Acknowledging that the authorities of the SEC and CFTC can be questioned due to their independent statuses, the report recommends the codification of President Joe Biden’s AI executive order and subsequent Office of Management and Budget guidance, extending both documents to independent agencies to “ensure consistent application of AI policy.”

Other recommendations from the HSGAC majority staff include clarifications from the SEC and CFTC on how they currently apply regulations to AI-related technologies, disclosures from hedge funds on their use of AI, and mandated audits of AI trading systems and disclosures to investors when the technology is used.

In interviewing six hedge funds as part of the report, staffers found a variety of ways in which AI and machine learning are being applied to the work. All six said that humans review their AI systems and trading decisions, though some said they “largely rely on these systems” and others noted that they “believe human intuition is required” in that type of work.

There was also no consensus from those hedge funds on when interventions with the technology should occur, how risks are classified, how various terms are defined, and what their general interests and intended uses are for AI and machine learning. Some hedge funds shared that they have “begun exploring the use” of generative AI but had not yet put the technology to practice.

During a Senate Appropriations Financial Services and General Government Subcommittee hearing Thursday on fiscal 2025 budget requests, the SEC’s Gensler said that the “transformative power of predictive data analytics” is “going to raise new challenges” for the agency, while CFTC Chairman Rostin Behnam said the regulator is seeking industry feedback on its AI use as part of an effort to “keep parity with a really fast-moving market.”

“It’s going to bridge gaps between retail investors and institutional investors and it’s going to create, I think, blurry lines about how we’re able to oversee markets,” Behnam said.

Bryan Corbett, president and CEO of MFA, a trade group representing the global alternative asset management industry, said in an email to FedScoop that the “overtly-political report” from HSGAC “is not representative of the industry today, and sets back public discourse around an important topic.”

“Alternative asset managers use technology to generate returns throughout the economic cycle for their investors, including pensions, foundations, and endowments,” Corbett said. “This partisan report fails to recognize long-accepted current market practices which serve investors and enhance market efficiency.”

This story was updated June 14, 2024, with comments from MFA’s CEO and president.