SBA pushes forward with modernization under working capital fund

The Small Business Administration is now actively using money from its IT working capital fund to support a variety of modernization efforts.

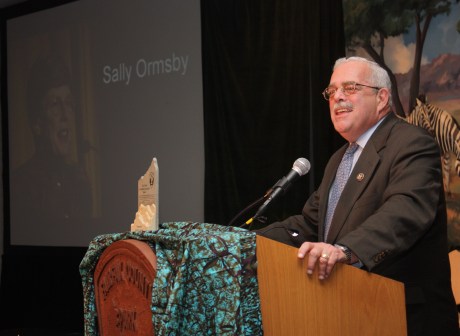

SBA is currently using $6 million in funding it didn’t spend in fiscal 2019 to support seven ongoing IT modernization projects, Deputy CIO Guy Cavallo said May 28 during an AFCEA Bethesda webinar.

Considering SBA’s annual total IT budget of $117 million, “it was a decent-sized chunk,” Cavallo said of the money in the fund.

SBA is one of the very few agencies that jumped at the opportunity lawmakers provided agencies under the Modernizing Government Technology Act to start IT working capital funds. The idea is that once Congress authorizes a fund, agency CIOs can save any unspent IT budget for modernization projects.

The MGT Act also created a central, governmentwide Technology Modernization Fund from which federal agencies can apply to take loans for modernization projects. The TMF has awarded a total of $90 million to seven distinct projects— two at both the U.S. Department of Agriculture, General Services Administration, and one apiece at the departments of Energy, Housing and Urban Development, and Labor. More recently, lawmakers have proposed billions in funding for the TMF to support glaring modernization needs made obvious in the coronavirus.

But the SBA is probably too small to take advantage of the central TMF fund, said Cavallo, who is now one of SBA’s senior-most IT leaders after Maria Roat stepped away from the CIO role last month to become the deputy Federal CIO.

“You know, SBA being its size … if I was the [Department of Defense] or somebody I would have to go to the TMF and get the bigger box,” he said.

But by opting to use its own working capital fund, SBA gets the opportunity to manage that money at its own pace. It also helps to “break the agency out of the habit of in September, if there’s a lot of money that fell out because contracts didn’t come through, whatever, just buying hardware” simply to use up leftover funds or risk losing them, Cavallo said. “We wanted to be able to invest in legacy modernization and people.”

It wasn’t an easy path to get there, though. Cavallo echoed the struggles other CIOs have had: Despite the intent of the MGT Act to allow agency working capital funds, some agencies weren’t legally cleared to use them. “We discovered that we did not have the authority” to set one up, he said of the start of SBA’s journey.

Rep. Gerry Connolly, D-Va., one of the authors of the MGT Act, expressed his irritation about this fact last summer during an oversight hearing.

“One of the things we encountered was agencies saying, ‘Well, we’re creating a fund within our agency to be able to capture the savings effectuated in FITARA, but our lawyers are telling us we can’t use them. We can’t put money in them because that’s an appropriations function,’” Connolly said. He continued later, “Our view is — the law is the law. We passed the law. It’s quite clear what the intent is.”

In the SBA’s case, the CIO’s office worked with agency attorneys to clear things up.

The Department of Labor and the General Services Administration both had existing funds that fulfilled the intent of the MGT Act and have received the blessings of lawmakers, like Connolly, who have IT oversight. Other agencies like the departments of Education and Commerce have asked to stand up new funds and are committed to using them but still haven’t gotten the legal go-ahead to do so.